Contents:

We’ll talk about two popular investment options, Exchange Traded Funds and Fund of Funds (FoF’s). To invest in a WealthBasket, you need to have an active trading and Demat account with any of the brokers. You also need to have a clear ledger balance with your broker to invest in the underlying stocks and ETFs. A WealthBasket is a combination of equities and ETFs created and managed by SEBI registered professionals. Each WealthBasket reflects an investment strategy, theme or sector.

For example, Motilal Oswal NASDAQ 100 Index ETF provides you with exposure to the internet and technology companies listed on the Nasdaq stock exchange. Exchange-Traded Funds are passively managed funds, whereas Funds of Funds are managed by seasoned professionals. As we’ve seen, both of these investment options are distinct and expose investors to different levels of risk. It is an open-ended fund of funds scheme that invests in units of one or more mutual fund schemes / ETFs, which are domiciled overseas and predominantly invest in US markets. The double blow of the pandemic and the Ukrainian war exposed the fault lines in the global commodity markets. The pandemic jammed supply chains, increased commodity prices, and pushed the costs of handling and shipping steeply.

Valentine’s Day and Personal Finance: A Match Made…

An SIP eliminates this by automating the payments which means that every month, a predetermined amount will automatically be deducted from your bank account. So, there is no way that you would miss out on making the payments. Power of Compounding – According to the principle of compound interest, any small amount of money when invested for a longer period of time can get compounded and fetch you good returns.

However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment. In simple words, inverse securities move in an opposite but equal direction to the Underlying benchmark or index. Oil ETFs attempt to track the comparative index cautiously, but minor performance discrepancies could be discovered, specifically, if the time frame is short. An oil ETF is referred to an Exchange-Traded Fund that invests in such firms and companies that are operating in the oil and gas Industry. Companies that get included in the ETF are involved in the discover, production, distribution and retail dealings along with the commodity.

Terms You Need To Know Before Investing In ETFs

Their https://1investing.in/ is largely determined by the index or benchmark they track. The performance of the FoF, as well as the underlying funds, is determined by the fund manager’s performance. Rebalancing is re-aligning the constituents or the weightage of the stocks and ETFs in a WealthBasket. It ensures that WealthBasket continues to reflect the latest version of an underlying research/investment methodology.

- The index represents bonds issued by specific public sector companies.

- Each investment strategy has its own set of benefits as well as drawbacks.

- This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal.

- Chennai, April 3 Credit rating agency Acuite Ratings & Research on Monday said it has revised its forecast of India’s current account deficit to $68 billion from $106 billion and the…

- Investors shall invest at their own discretion, will and consent.

In the global markets, we have plenty of options via ETFs (exchange-traded funds) to add a commodity like oil to our portfolio. To add to it, international markets are now not beyond the reach of an Indian investor. One can start investing internationally by opening a brokerage account in the US from India in a very easy manner. Further, under the RBI’s Liberalized Remittance Scheme, an Indian resident can legally transfer up to $250,000 to invest internationally. Hence, unlike active mutual funds, there is no scope for Fund Managers to take any active investment call.

ProShares Ultra Bloomberg Crude Oil

Clearitemized deductions: what they are, how they cut tax bills serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. However, one important thing to note here is that renewable energy producers and providers may not be factored in the energy sector; thus, clean energy ETFs can be used to invest in such businesses. E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Oil prices were weighed down by May contracts expiring Tuesday. In addition, the industry has been hit hard by the coronavirus pandemic, which has cratered demand.

- India has an abundance of zinc and aluminium; however, we need more essential ingredients that go into Electric Vehicles , like nickel, lithium, copper, etc.

- Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

- They are available on the National Stock Exchange and the Bombay Stock Exchange .

- However, you should look at the ETFs’ liquidity and opt for those with high liquidity to not face any problems while redeeming the investments.

- A mutual fund scheme that invests in other mutual fund schemes / ETFs is known as a Fund of Fund.

- If you are subscribing to an IPO, there is no need to issue a cheque.

Equity ETFs in India invest in a basket of securities similar to the index to allow for higher diversification and return on investment. Similar to other types of ETFs, equity ETFs also trade on the stock exchanges and can be bought and sold anytime within the trading sessions. ETFs are investment funds that trade on stock exchanges like individual stocks. They are designed to track the performance of a particular index, sector, or commodity.

Add to Portfolio

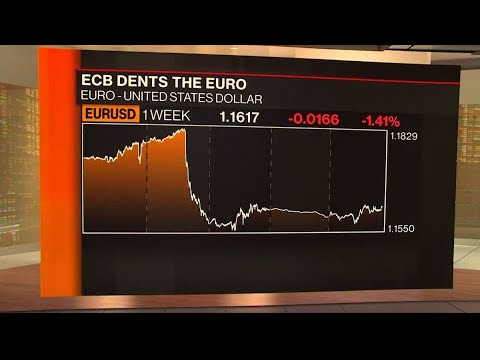

By Barani Krishnan Investing.com — After treading water or sliding for four straight sessions, oil rallied on Tuesday for the first time since traders got excited over talk of new OPEC+… However, as global economies open up in mid 2021, the oil prices have been firming up in expectation of demand coming back in the economy. Over the last 12-months, the price is up by nearly 75 per cent while year-to-date, the price is up by about 35 per cent. There are nearly 11 oil ETFs traded on the U.S. markets, with total assets under management of about $6.29B. Since then, crude oil prices have bounced back strongly over the past few months to cross $60 per barrel on 17 February.

You can invest in it, and you will have to open a demat account if you wish to buy oil company stocks or trade in crude oil with futures contracts. If you are buying futures contracts in crude oil, you should know that they are traded in lots of 100. The best part of futures contracts is that you do not have to pay the full amount of units traded upfront. Besides oil, to diversify a portfolio further, you can go in for any upcoming IPO after doing some background checking.

Oil ETFs: What You Should Know Before You Invest – Macrohive

Oil ETFs: What You Should Know Before You Invest.

Posted: Thu, 08 Sep 2022 07:00:00 GMT [source]

You can invest in thematic and sectoral stock and ETF baskets that take advantage of market trends. This time invest in WealthBaskets created by SEBI registered professionals. You have set a goal for yourself and are looking for the right investments to achieve them. With WealthBaskets, you can own the underlying stocks and ETFs. Sharing the simple trend following trading strategy, traders can add their own rules in this, to minimise the losses and maximise the profits.

Investors oversubscribed CPSE ETF anchor portion 5.57 times

If a country removes subsidies of oil, it allows the country to enhance the production of oil. By Liz Moyer Investing.com — U.S. stocks were mixed on Monday after a surprise output cut by the Organization of the Petroleum Exporting Countries and its allies stoked inflation fears and… By Barani Krishnan Investing.com — OPEC+ appears to have hit bull’s-eye with its skilfully orchestrated move to recapture $80 and above for a barrel. By Barani Krishnan Investing.com — Recession worries have started dominating markets of all shapes and sizes outside of oil, a day after OPEC+ announced a second production cut in four… Crude oil yesterday settled down by -0.21% at 6605 as the market weighed worsening economic prospects against expectations of U.S. crude inventory declines. By Barani Krishnan Investing.com — One of the most crafty moves to boost the oil market should result in a weekly gain at least in crude prices — which is exactly what OPEC+ got this…

Interestingly, Oil ETFs can be Commodities based and also equity-based funds. Here, we look at crude oil ETFs that track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. If you want to make investments in mutual funds but don’t have enough money to do so at one go, you can always consider systematic investment plans . These plans allow you to systematically invest a small sum of money on a regular basis . However, to invest in the right funds, it is essential to know which funds are performing well and identify those that aren’t.

There are material risks investing in oil ETFs that investors need to know before buying them. The largest Oil ETF is the United States Oil Fund LP with nearly $3.20B in assets. The USO is an exchange-traded security whose shares may be purchased and sold on the NYSE Arca.

Past performance should not be taken as an indication or guarantee of future performance. Kindly note that investment in securities markets is subject to market risks, read all the related documents carefully before investing. The USO fund is designed to track the daily price movements of WTI crude oil, offering investors exposure to the commodity without a futures account. The fund composes 25% of all outstanding contracts in WTI crude futures, according to Bloomberg.