Contents:

Trendlines that have an upward or downward slope are called ascending or descending trendlines, respectively. Trendlines can vary in length and can be used across multiple timeframes. While investors should draw trend lines on a time interval period that aligns with their investing strategy, the most reliable trend lines will be clearly visible on a weekly stock chart. The longer the trend, and the more data points you can connect, the more confident you can be in that trend. Technical analysis has the same limitation of any strategy based on particular trade triggers.

But I hope this knowledge will help you tip the odds in your favor. Other economic indicators include consumer sentiment, as well as the money supply and interest rates set by the Federal Reserve. Examples of economic indicators include data presented by the Department of Labor or the Institute of Supply Management .

For instance, a bank’s revenue might outpace competitors, but its stock price could be threatened by falling interest rates. A food processing company with slow earnings growth could see shares accelerate as the economy enters a recession and investors seek stability. (Everyone still eats, even when the economy tanks.) A pharmaceutical stock could lose ground when a key competitor launches an exciting new product. It implies that once a trend is established, future prices tend to follow the direction of the trend. Such an assumption is the basis of many strategies for technical trading.

Air Filter for Automotive Market Set to Witness Unprecedented … – GlobeNewswire

Air Filter for Automotive Market Set to Witness Unprecedented ….

Posted: Mon, 17 Apr 2023 14:35:21 GMT [source]

If the price is above VWAP, that means most longs are profiting. Sometimes a stock breaks a resistance level, only to get stuffed right back down. Support and resistance levels aren’t perfect — they’re ranges.

Over 1.9 million investors trust StockCharts.com to deliver the tools and resources they need to invest with confidence.

It usually happens when you see a stock’s price making sudden rallies and turnarounds without establishing any clear uptrend or downtrend. Such a situation can last for several weeks or even months leaving traders embarrassed . Technical analysis attempts to turn past patterns of price movements into a prognostication about future price movement.

- There are different chart types, including line, bar, and candlestick charts.

- This strategy can be used to determine the strength and weakness of the price of a stock.

- A trend is a general direction the market is taking during a specified period of time.

- Though there’s no difference in the value of the investment, artificial price changes can dramatically affect the price chart and make technical analysis difficult to apply.

- More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software.

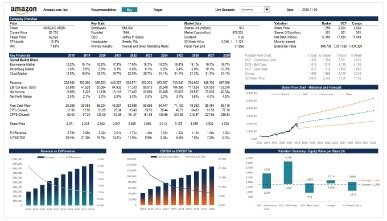

Return on Equity –It measures how effectively a company uses its assets for producing earnings. A high ROE implies that a company squeezes out greater profits with available assets. Hence, with all other things equal, it will be better to invest in high ROE companies in the long run. Relative Vigor Index – oscillator measures the conviction of a recent price action and the likelihood that it will continue. These indicators are based on statistics derived from the broad market.

How Do You Analyze Stock Trends? 6 Tips for Traders

Weekly trend analysis of stocks and ETFs trading on NYSE, AMEX, NASDAQ and TSX exchanges. ” observed 19,646 Brazilian futures contract traders who started day trading from 2013 to 2015, and recorded two years of their trading activity. The study authors found that 97% of traders with more than 300 days actively trading lost money, and only 1.1% earned more than the Brazilian minimum wage ($16 USD per day). The first is in overlays, like moving averages or Bollinger Bands©, which are plotted on top of a stock chart. Different investors will assign different levels of value to news catalysts.

Machine Tools Global Market Report 2023: Increased Need for Higher Efficiency and Precision in Complex Machining Tools Drives Sector Growth – Yahoo Finance

Machine Tools Global Market Report 2023: Increased Need for Higher Efficiency and Precision in Complex Machining Tools Drives Sector Growth.

Posted: Mon, 17 Apr 2023 11:13:00 GMT [source]

Once you pick your sector, it’s time to look at its general performance. That includes anything that can affect it — new government regulations, shortages of a specific raw material, and so on. Trend analysis can help you pick optimum times to enter and exit stock positions — helping you become an overall better trader. Both upward and downward trends can be identified by using trend analysis.

Stock Trends Portfolios

Head And Shoulder PatternThe head and shoulders (H&S) pattern are one of the most widely used chart patterns by traders in the stocks and Forex markets. Traders can identify the pattern from the three tops that form, with the middle indicating the highest price trend and the end of an uptrend. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon.

- Engage with the markets and your portfolio in entirely new ways with a highly-interactive charting experience that knows no bounds.

- The wheat trade carried the momentum from Friday into today with another round of double digit gains.

- You deserve to stay focused on the charts without worrying about your bill.

- A new government or changes in the industry serve as forces that impact the market.

Ever since prices first began to be charted, investors have been devising strategies for interpreting their movements. Below are a few examples of more common stock chart technical analysis techniques. Some external factors are so important they influence almost every company. These include interest rates, crude oil prices, market cycles , jobs growth, inflation, and consumer confidence. Each month, the government releases fresh data on employment, inflation, consumer sentiment, and other economic trends.

Types of Trend Analysis

It is not possible to invest or trade without understanding how a stock market functions. To invest wisely in stocks, it is essential to learn how to do trend analysis effectively. This will help you make smarter decisions and reap benefits from the market.

The price-to-earnings (P/E) ratio is the closest thing to a price tag on a stock. To calculate P/E, take the stock’s price and divide it by the most recent annual earnings per share . Price to Earnings to Growth ratio –The PEG ratio helps to determine the value of a company’s stock while considering the earnings growth of the company.

Trends are made up of peaks and troughs over time, allowing one to predict the overall price movement of a security. They say, you must trade in the trend direction, and, during the correction, you should wait until it ends, and the key matter is “how to know one from the other? ” This article may completely change your view on the price chart. You can stick to this direction as long as the price zone does not move, i.e. no volume will be accumulated and exceed the volume of the previous value zone. When enough volume gets collected, stocks gain momentum, and the trend either continues or reverses.

Pharmaceutical Solvents Market Analysis, Trend, Future Scope … – Digital Journal

Pharmaceutical Solvents Market Analysis, Trend, Future Scope ….

Posted: Mon, 17 Apr 2023 10:18:35 GMT [source]

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Watch the Slope – The slope of a trend indicates how much the price should move each day. But, if the line is too flat, it questions both the validity of the trend and its predictive powers. There is a specific time frame for a movement to be considered a trend. However, the longer the trend moves in an upward or downward direction, the more noticeable a trend becomes.

Major Market Indices

On the other hand, if the analyst is a disgruntled perma-bear, then the stock market trend analysis will probably have a bearish tilt. It’s important to determine whether or not a security meets these three requirements before applying technical analysis. That’s not to say that analysis of any stock whose price is influenced by one of these outside forces is useless, but it will affect the accuracy of that analysis. A simple moving average line equals the sum of all the prices of a stock over a given time, divided by that time frame. Some standard moving average time frames are 20, 50, and 200 days.

A support line represents a stock price low maintained over a defined time frame, while a resistance line represents a stock price high maintained over a defined time frame. These lines are often used as buying or selling indicators—buyers purchase the stock at a certain low price point over time , and sellers sell the stock at a certain high price point over time . If the price closes above the weekly average, the market will continue to move up for quite a long time afterward, in the opposite case — the market will experience a downtrend. Despite its reliability, the Moving Average indicator can be lagging, which makes it less suitable for medium time frames and short-term trading.

With slight changes, the same analysis can be used in all markets. Internal use of the trend analysis in accounting is one of the most useful management tools for forecasting. For forecasting, estimated financial statements trend analysis is used for the head where no significant changes have happened. For example, suppose employee expense is taken 18 % of the revenue, and considerable changes have not been made in the employees, then for estimated financial statements.

Friday was a very volatile day for Gold, with the price dropping around 500 pips from top to bottom and closing the week marginally above 2k. However, the bullish structure of the chart remains intact and, in my opinion, we are still going for a new ATH. Short term support is under 2k, around Fiday’s low, and dips in that zone should be considered good buying… Moving average– an average over a window of time before and after a given time point that is repeated at each time point in the given chart.

If a stock has already advanced significantly, it may be prudent to wait for a pullback. Or, if the stock is trending lower, it might pay to wait for buying interest and a trend reversal. With a selection of stock charts from each industry, a selection of 3-4 of the most promising stocks in each group can be made.

If the broader https://trading-market.org/ were considered to be in bullish mode, analysis would proceed to a selection of sector charts. Splits, dividends, and distributions are the most common “culprits” for artificial price changes. Though there’s no difference in the value of the investment, artificial price changes can dramatically affect the price chart and make technical analysis difficult to apply.

In the United Kingdom, the industry is represented by the Society of Technical Analysts . The STA was a founding member of IFTA, has recently celebrated its 50th Anniversary and certifies analysts with the Diploma in Technical Analysis. In Canada the industry is represented by the Canadian Society of Technical Analysts. In Australia, the industry is represented by the Australian Technical Analysts Association , and the Australian Professional Technical Analysts Inc. Combining ordinal forecasts with an application in a financial market. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

If you need a simpler approach to stock market analysis and stock trading… After years of following markets and investing, diligently trying to understand how and why stocks move, it’s time you put aside the questions of ‘how’ and ‘why’. The available research on day trading suggests that most active traders lose money. Fees and overtrading are major contributors to these losses. Indicators are statistics that measure current market conditions and also forecast potential economic or financial trends. A news catalyst is any kind of event or revelation that can cause a dramatic change in the price of a stock or markets as a whole.

If the data is incomplete, inaccurate, or otherwise flawed, the analysis may be misleading or inaccurate. The soy complex gained more than 1% in most contracts to start the week. Beans were up 0.7% to 1.2% on the day, led by the old crop contracts. November soybeans were up by a dime at the close, but are… The CME Lean Hog Index was $71.63, down by 32 cents for 4/13.